If you actually think your savings account will fund your retirement, bravo! Prepare for decades of ramen dinners and “what were you thinking” moments. Time to ditch the piggy bank

retirement planning

Congratulations! You've decided to pursue financial independence by... doing absolutely nothing about it. Bravo! Without a plan, your dream is as meaningful as a motivational quote on a coffee mug.

Oh, sure—keep living like a frat kid while your future self begs for spare change. “Too young to care about retirement”? That’s just adulting procrastination with a credit card. Start

Newsflash: if you're too lazy to invest today, your future self will be screaming in financial despair. Stop being an idiot, put your money to work now, or forever wallow

Thinking your retirement plan is just “work until you drop”? Brilliant strategy—if you love endless grind and stress! Maybe try actually saving, investing, and planning to live your golden years

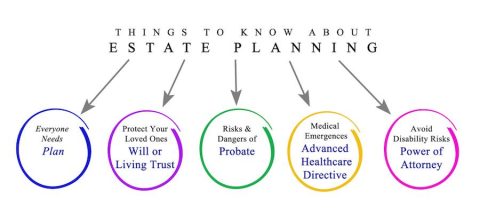

Sure, you've nailed your investments and savings—but what happens when you’re six feet under? Without an estate plan, your legacy turns into a family circus. So stop winging it and

Oh, you think parking your cash in a savings account is your ticket to sipping piña coladas in retirement? Adorable! Newsflash: earning pennies in interest won’t fund those golden years.

Think you’re too old to learn investing? Bravo for mastering the art of financial stagnation! Newsflash: your money isn’t getting any fatter by sitting idle. Quit whining, grab a book,

So, you got a financial advisor but feel dumber than a bag of rocks? Relax, you're not alone, Einstein! Step one: ask questions—even the ones that sound stupid. Step two:

So, you're banking on winning the lottery to retire? Genius plan—because who doesn’t want to hedge their future on one-in-a-billion odds? Maybe aim higher, like finding a unicorn or discovering

Load More