Hey there, money maestro! 🎶 If you’ve ever found yourself wondering where all your money disappeared to by the end of the month, you’re definitely not alone. It seems like we blink and poof—our hard-earned cash is gone! But don’t worry, because we’re living in the golden age of technology. Enter the world of financial apps! These digital marvels not only help you keep tabs on your spending but can also guide you to smarter financial choices. In this article, we’ll dive into how you can use these handy tools to track your expenses, manage your budget, and even improve your spending habits—turning you into a budgeting boss in no time. Ready to take control of your wallet? Let’s get started! 🚀

Choosing the Right Financial App for Your Needs

When picking a financial app, it’s important to consider what you need it for. Are you trying to budget better, track your expenses, or invest your money wisely? There are apps designed for each of these purposes. For budgeting, apps like Mint and YNAB can help you categorize and manage your expenses efficiently. If you’re focused on tracking expenses, Expensify and Spendee make it easy to photograph receipts and keep tabs on where your money is going.

Take a moment to think about what features matter most to you:

- User Interface – Is it easy to navigate?

- Security – Does it offer robust protection for your data?

- Cost – Are you willing to pay for premium features, or do you need a free solution?

- Integration – Does it connect with your bank or other financial tools?

| App Name | Best For | Cost |

|---|---|---|

| Mint | Budgeting | Free |

| YNAB | Budgeting | Subscription |

| Expensify | Expense Tracking | Free/Paid |

| Spendee | Expense Tracking | Free/Paid |

Setting Up Your Financial App for Success

Getting started with your financial app can be a game-changer for keeping tabs on your money. First, download and install the app that best suits your needs from the App Store or Google Play. Once you’ve got it up and running, connect all your accounts—bank accounts, credit cards, and even investments if the app allows. This helps you get a full picture of your financial situation. Remember to set up alerts for spending limits and due dates to keep everything on track. Don’t forget to update your income and recurring expenses so the app can provide accurate insights.

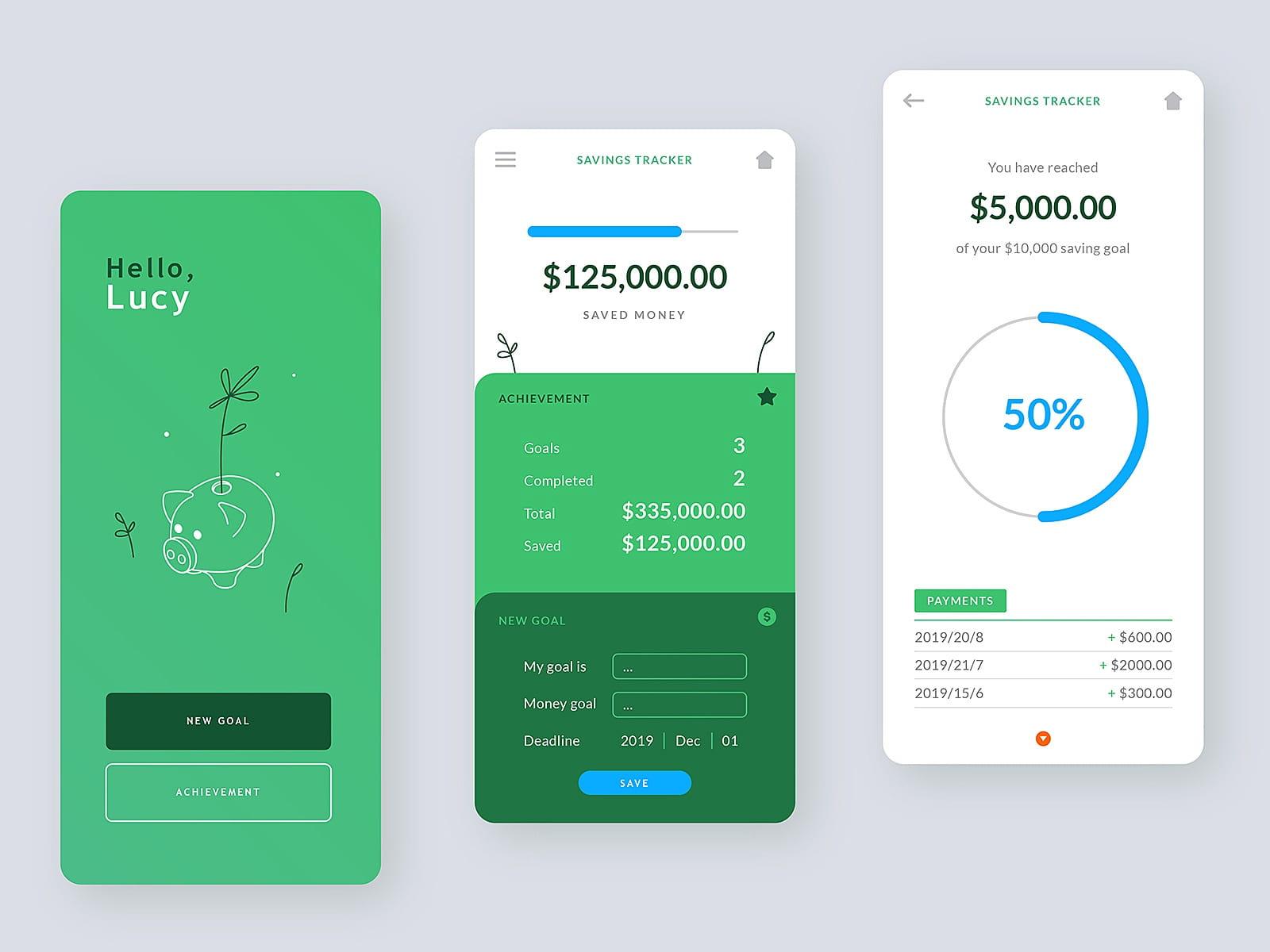

Next, take advantage of your app’s features. Most apps offer spending categories such as groceries, entertainment, and utilities to help you see where your money is going. Many also allow you to set budgets for each category and will notify you if you’re getting close to your limit. If your app offers goal-setting functionalities, use them to save for special items like vacations or big purchases. Here’s a quick look at how this can be beneficial:

| Feature | Benefit |

|---|---|

| Budgeting | Helps manage day-to-day spending |

| Alerts | Avoid late fees and overspending |

| Goal-Setting | Plan for big purchases and savings |

Breaking Down Your Spending Habits with Detailed Insights

Ever wonder where all your money goes each month? With financial apps, you can get detailed insights into your spending habits. These apps categorize your expenses automatically, helping you see exactly which areas you spend the most on. This not only allows you to identify any overspending but also helps in setting more realistic budgets. Here are some common categories these apps might track:

<ul>

<li>Food & Dining</li>

<li>Transportation</li>

<li>Entertainment</li>

<li>Utilities</li>

<li>Shopping</li>

</ul>

<p>Many of these apps come with nifty features like spending alerts, which notify you when you’re approaching your budget limit, and visual breakdowns like pie charts and graphs that make analyzing your finances a breeze. To give you an idea of how these charts might look, here’s a mock-up:</p>

<table class="wp-block-table">

<thead>

<tr>

<th>Category</th>

<th>Monthly Expenditure ($)</th>

</tr>

</thead>

<tbody>

<tr>

<td>Food & Dining</td>

<td>300</td>

</tr>

<tr>

<td>Transportation</td>

<td>150</td>

</tr>

<tr>

<td>Entertainment</td>

<td>100</td>

</tr>

<tr>

<td>Utilities</td>

<td>200</td>

</tr>

<tr>

<td>Shopping</td>

<td>250</td>

</tr>

</tbody>

</table>

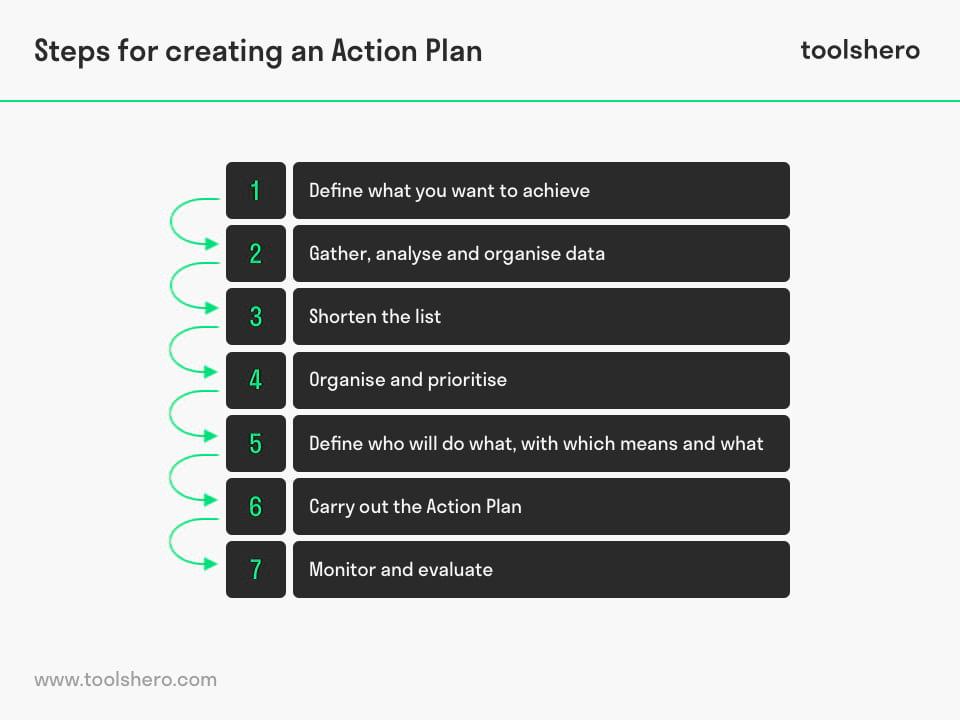

Creating Actionable Plans to Improve Your Financial Health

When it comes to taking charge of your financial well-being, financial apps can be your new best friend. These handy tools can help you monitor your spending patterns, set and stick to a budget, and even remind you about upcoming bills. Many of these apps offer features like:

- Automatic categorization of your expenses

- Customizable budgeting goals

- Alerts for unusual spending

- Investment tracking

It’s not just about tracking; it’s about making sense of that data to craft actionable goals. For instance, if you notice you’re spending too much on dining out, set a monthly limit for restaurant expenses. Here’s a quick comparison of popular financial apps to help you decide which might be right for you:

| App | Key Feature | Price |

|---|---|---|

| Mint | Comprehensive budgeting | Free |

| YNAB (You Need A Budget) | Detailed spending plans | $11.99/month |

| Personal Capital | Investment tracking | Free |

Q&A

Q: Why should I use financial apps to track my spending habits?

A: Great question! Financial apps make it super easy to keep an eye on where your money is going. Instead of guessing or struggling with messy spreadsheets, these apps automatically categorize your expenses. It’s like having a personal financial assistant right in your pocket!

Q: Can’t I just use Excel or a notebook for budgeting?

A: You totally can, and some people do prefer that approach. But financial apps save you a ton of time and effort. They link directly to your bank accounts, credit cards, and even investment accounts, giving you real-time updates. Plus, they can provide insights and trends that would take you forever to figure out manually. It’s all about making your life easier.

Q: What’s the first step to using a financial app?

A: Start by downloading a reputable one from your app store. Mint, YNAB (You Need A Budget), and PocketGuard are some popular choices. Once installed, sync your bank accounts and any other financial accounts. The app will then start tracking your transactions and categorizing them automatically.

Q: Are these apps safe to use?

A: Security is a big deal, and most of these apps take it very seriously. Look for apps that use bank-level encryption and have strong privacy policies. Also, read some reviews to see how other users feel about their security features. It’s always smart to do a bit of homework before diving in.

Q: How do these apps help improve my spending habits?

A: They do more than just track spending. They provide insights into your financial behavior, show you trends, and even help set budgets. For example, if you’re blowing your paycheck on dining out, the app will highlight this and help you set more realistic spending limits. It’s almost like having a financial coach nudging you towards better habits.

Q: What if my financial situation is complicated? Will an app still help?

A: Absolutely! These apps are designed to handle various financial scenarios. If you have multiple income streams, expenses, and investments, they can still keep track of everything. Some even offer tailored advice and tips based on your specific situation.

Q: Do these apps cost money?

A: Many financial apps offer free versions with basic features. If you need more advanced tools and insights, you might have to pay for a premium version. However, the free versions are pretty powerful and can definitely help get you started on the right track.

Q: I’m not very tech-savvy. Are these apps user-friendly?

A: Most of them are, yes! They’re designed to be intuitive and user-friendly, even for beginners. Many apps have step-by-step guides, tutorials, and even customer support to help you out if you get stuck. You’ll be surprised at how quickly you can get the hang of it.

Q: Can these apps help me save money?

A: Definitely! By tracking your spending and comparing it with your budget, these apps highlight areas where you can cut back and save. They might even suggest switching to cheaper service providers or give you targeted savings tips. It’s like having someone constantly looking out for your wallet!

Q: What if I don’t hit my budget goals?

A: Don’t stress about it. Financial apps help you understand your spending patterns and make adjustments. If you don’t hit your goals one month, use that information to tweak your budget for the next month. It’s a learning process, and every bit of information helps you get better at managing your money.

Q: Any final tips?

A: Just dive in and start using one! Everyone’s finances are different, so the key is to find an app that fits your needs and lifestyle. And be consistent — check in with the app regularly to keep tabs on your progress. Happy budgeting! 🌟

Feel free to dive into the world of financial apps and take control of your spending habits. It’s easier than you think and can make a huge difference in your financial health. If you have more questions, don’t hesitate to ask!

Wrapping Up

And there you have it—your ultimate guide to using financial apps to stay on top of your spending habits! Hopefully, you’re now ready to take on the world of personal finance with a little more confidence and a lot more savvy. Remember, it’s all about finding the right tools that fit your lifestyle and making them work for you. Don’t be afraid to experiment, and keep tweaking until you find your groove. Your wallet will thank you!

Got any favorite apps or tips we didn’t mention? Drop them in the comments! Happy saving, everyone!💰📱